By Jennifer Johnson

Managing Editor

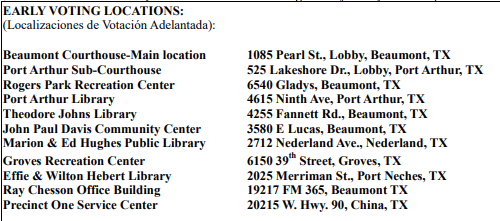

Early voting for the Nov. 2 Jefferson County Joint Election and Constitutional Amendment vote ends Friday, Oct. 29, the Oct. 28-29 polling locations operating extended hours of 7 a.m. – 7 p.m. the last two days, according to Aaron Kelley, Elections Manager.

Polls have been operational since Monday, Oct. 18, although voter visits have been sparce. More than a week in, just over 1,000 voters had cast ballots. In the most recent general Election, more than 9,0000 votes had been cast on the first day of early voting.

“It’s starting to build but it’s been slow,” Kelley said, explaining that Constitutional Amendment ballots seldom draw large crowds. “We don’t have, say, candidates in hotly contested races.”

What the county does have, however, is two firefighter collective bargaining initiatives, two city council races and a school board seeking a bond issuance in excess of $1 million.

“Some efforts are picking up,” Kelley said, pointing to the firefighter initiatives that have produced two propositions each for cities of Port Neches and Groves voters. “Areas like that, and Bevil Oaks, where voters are voting on a mayor, we see more of a turnout there.”

Due to the joint municipal elections, smaller cities in the county – outside of Beaumont and Port Arthur – represent the lion’s share of the Jefferson County ballot.

In Groves, councilmembers are being selected for Ward 1 – which is uncontested for sole candidate Mark McAdams – and Ward 3, which has three candidates in Rob Vensel, Michael Campise and Barbara Edington.

Additionally, Groves voters will decide on two propositions concerning the municipality’s firefighters, which would prompt changes to the city charter. The same propositions are simultaneously being posed to Port Neches voters, as well. Specifically, voting in favor of Proposition A in each city would adopt the state law allowing firefighters to establish a collective bargaining employees association; and voting in favor of Proposition B amends the city charter to give the International Association of Fire Fighters (IAFF) the authority to require the city to participate in binding arbitration should collective bargaining negotiations fail. Groves would be represented by the IAFF Local 1905. Port Neches would be represented by the IAFF Local 3713.

Bevil Oaks voters have three elected offices to fill – that of the Mayor, between candidates Barbara Emmons and Jennifer Joyce; Councilmember Ward 1, from candidates Billy Canant, Louis “Bud” Merendino, and Phillip Neichoy; and Councilmembers Ward 3, between Cherilyn Mitchell and Doug Mullins.

Only one bond election made it to the ballot this election cycle – that of $1.4 million property tax increase bond issuance for the Hamshire-Fannett Independent School District. According to ballot information, the borrowed money would be used to construct and equip a concession stand at the district’s high school football stadium. The stand would be fit with restrooms, as well as possibly contain “one or more locker rooms and related facilities.”

All Texas voters are being asked to weigh in on multiple Constitutional Amendment propositions, some vague on the ballot as to the true nature of the question being asked, others extremely specific.

In Proposition 1, voters are being asked if they are for or against a constitutional amendment “authorizing the professional sports team charitable foundations of organizations sanctioned by the Professional Rodeo Cowboys Association or the Women’s Professional Rodeo Association to conduct charitable raffles at rodeo venues.” The proposition adds both charitable groups to the list of approved parties eligible to conduct charitable raffles, and changes the venues allowed from only sports games to also include rodeo arenas.

Proposition 2 asks if voters are for or against “authorizing a county to finance the development or redevelopment of transportation or infrastructure in unproductive, underdeveloped, or blighted areas in the county.” Currently, only cities and towns are authorized to issue such bonds. Text that would be added to the Texas Constitution should Proposition 2 pass precludes the county from pledging for the repayment of those bonds or notes at more than 65% of the increases in ad valorem tax revenues each year or using proceeds from the bonds to finance the construction, operation, maintenance or acquisition of rights-of-way of a toll road.

Texas voters are being asked to check if they are for or against “a constitutional amendment to prohibit this state or a political subdivision of this state from prohibiting or limiting religious services of religious organizations” in Proposition 3. If voters agree, the proposition would invoke a completely new section to Article 1 of the Constitution. As presented, the new Sec. 6-a: “This state or a political subdivision of this state may not enact, adopt, or issue a statute, order, proclamation, decision, or rule that prohibits or limits religious services, including religious services conducted in churches, congregations, and places of worship, in this state by a religious organization established to support and serve the propagation of a sincerely held religious belief.”

Proposition 4, as written on the ballot, changes “the eligibility requirements for a justice of the supreme court, a judge of the court of criminal appeals, a justice of a court of appeals, and a district judge.”

A “for” vote supports making changes to eligibility requirements for the above named officeholders elected or appointed to a term after Jan. 1, 2025, that includes requiring candidates to be residents of Texas; hold 10 years of experience in Texas as a practicing lawyer or judge of a state or county court for candidates of the supreme court, Texas Court of Criminal Appeals, or a court of appeals – without any lapses in licensing due to revocation or suspension; and eight years of experience in Texas as a practicing lawyer or judge of a state or county court for candidates of a district court.

Also drafted in the changes, the reference to only male judges was removed and replaced with gender-neutral affirmations.

Without context, Proposition 5 asking if voters if they are for or against “providing additional powers to the State Commission on Judicial Conduct with respect to candidates for judicial office” doesn’t detail that what is being sought is the ability for the commission to hold office candidates accountable the same way it holds current officeholders accountable through accepting complaints or reports, conducting investigations and taking any other action as authorized pursuant to its charge.

“The constitutional amendment establishing a right for residents of certain facilities to designate an essential caregiver for in-person visitation,” as recited in Proposition 6, … While not part of the ballot text, the amendment text also allows that “the legislature by general law may provide guidelines for a facility, residence, or center described by Subsection (a) of this section to follow in establishing essential caregiver visitation policies and procedures.”

Proposition 7 asks if voters are in favor of “The constitutional amendment to allow the surviving spouse of a person who is disabled to receive a limitation on the school district ad valorem taxes on the spouse’s residence homestead if the spouse is 55 years of age or older at the time of the person’s death.”

Currently, disabled individuals may apply for a $10,000 homestead tax exemption and a limit on school district property taxes, according to the Texas Comptroller. In order to qualify for the disabled exemption and tax limit, the individual must also qualify to receive disability benefits under the Federal Old-Age, Survivors, and Disability Insurance Program administered by the Social Security Administration. Property taxes on the residence of a disabled individual or their surviving spouse do not increase from the year the individual qualifies for the exemption and tax limit.

Lastly, voters are also asked to weigh in on Proposition 8: “The constitutional amendment authorizing the legislature to provide for an exemption from ad valorem taxation of all or part of the market value of the residence homestead of the surviving spouse of a member of the armed services.”

A “for” vote on Proposition 8 is a vote in support of providing that the surviving spouse of a member of the armed services of the United States who is killed or fatally injured in the line of duty in action is entitled to an exemption from ad valorem taxation of all or part of the market value of the residence homestead if the surviving spouse has not remarried since the death of the member of the armed services.

All early voting locations (listed in the graphic on Page 3) turn into voting locations on Election Day, Nov. 2, Kelley said, and will be joined by an additional 28 locations throughout Jefferson County. All registered voters of the county can vote at any polling location, Kelley added. Mail-in ballots will be accepted as long as they are postmarked by Election Day, Nov. 2.